Give the Gift of RVC Angel/Venture Capital Membership for Christmas*

* Give a membership (or join for yourself) to a friend, colleague or family member who you think would enjoy learning the nuts and bolts of venture capital and being a part of a community that sources, diligences, and invest in early stage startups.

Courses presented by Peter Adams, author of Venture Capital for Dummies.

Education

Trusted advisors ensuring accurate, efficient, and optimized tax filings tailored to your unique situation.

Community: Mentoring, events, workshops and volunteer deal teams.

Investing

There are no quotas and members can invest what they want and when they want, choosing from a large pool of deal flow.

About Us

Angel/Venture Education is Key for Success

If you're thinking of giving membership as a gift, or joining yourself, you can rest assured that the recipient won't be awkwardly unaware of how venture capital works. We have an extensive curriculum of two hour workshops for investors including topics like valuation of early stage companies, exit strategies, financial projections and analysis, due diligence, pitch critique, portfolio theory and market analysis.

People who jump in without education or a group to lean on for advice often lose money. RVC structures its deals to be tax free and many have rebates of 25-35% as economic development incentives. We're here to make a portfolio of angel investments profitable!

Services

What Does Membership Include?

Deal Flow

RVC sees over 1500 deals a year and can afford to be very selective and pick only the best. The deal flow is curated by the RVC team and members may choose to participate in final screening, if they desire.

Diligence

RVC uses AI driven diligence with a human analytical touch. Each deal comes with a non-biased due diligence report.

Leveraged Negotiation

Negotiation, not just for valuation, but also for deal structures that yield tax free returns for members. RVC also manages filing for economic development incentives, returning 25-35% of the investment back to eligible investors.

Syndication

We invest in the best deals anywhere in the country and many of the deals we see are "syndicated" to us and we share diligence and negotiation with other micro funds and angel groups.

Events/Social Engagement

There are lots of ways to engage socially at RVC. It starts with face to face (and hybrid) meetings with peer investors, followed by lunch or happy hour.

Hybrid Events (in person/Zoom)

We have angel investors from all over the country and around the world who benefit from RVC's events via Zoom. Local investors are invited to come in-person and follow-up for social events afterwards.

Curious about Angel Investing? Here are SEVEN Things you Probably Didn’t Know

There are a lot of people who are curious about angel investing and would like to get involved, but they’re not quite sure how it works and they keep putting it off. Here are a few things you may or may not know about angel investing that may encourage you to take the move and give it a try.

You can use your IRA or 401K for angel investments. That’s right - let’s say you don’t have $10 - 25k lying around right when you see a hot deal and you decide to pass. With your IRA/401K, you have a ready asset to put into play. (Keeping in mind that you should keep your angel investments under 10% of your investable wealth).

Angel groups totally change the game on angel investing. Maybe you were worried that term sheets, valuation and negotiation - or even just knowing if a deal was good enough to invest in - was too much work and required skills you were unfamiliar with. Angel groups cut all that work out and use professional methods to maximize success over some deal that your buddies on the golf course might throw your way. Consider joining Rockies Venture Club or other groups to learn more and share the skills an expertise among many smart people.

Angel investing is not as risky as you think! Many people think angels lose money on most of their deals, but the actual data, especially for angels investing in groups, is much brighter. You’re swinging for 10X returns on angel deals and indeed some don’t work out, but about half do work out. Not every deal is 10x of course, but some deals are 30x or even 100x, so it’s best to think about angel investing as a portfolio strategy. Across the board we plan to get a little over 3X on our portfolios.

Tax breaks and economic development incentives are game changers! What if the most you could lose on a deal after incentives was 35%? Would that change your attitude about angel investing? And what if you paid 0% taxes on 100% of your gains? No capital gains tax at all? These are force multipliers that rarely go into calculation of angel returns, but you can choose tax favored deals and leverage your investment with benefits you would never see in the public markets.

Angel investing can be a team sport. The financial gains are a benefit for sure, but angel investors are working with smart people with a variety of interesting backgrounds. They’re curious people and fun to get to know. Angel investing in groups is a focused social interaction that can provide meaning for your money and meaningfulness in your spare time activities. It’s a great way to meet new people and keep yourself active outside of your everyday life. Most people find angel investing to be fun and engaging on a variety of levels.

It’s not all about what you GET, but it’s also what you can GIVE. Angels often coach and mentor startups and help them in ways far more valuable than just capital. You may meet a founder that you can help through one of RVC’s many mentoring programs.

Angel investment is far from philanthropy, but it can feel like it sometimes when we invest in “impact” companies that provide not only financial return, but social or environmental benefits as well. RVC’s cleantech group, for example, sees innovative deals with clean energy, water resources, recycling and more. Wouldn’t it be great if your charities paid you back? Well, that’s one of the benefits of angel investing!

If any of these points makes you think this is a great gift for someone, with your membership gift they can start by taking some workshops at the Rockies Venture Club and we can take them deep into the technical aspects of angel and venture capital investing, or they can attend our pitch events and angel forums and observe the process and watch how others evaluate deals and compare that to your own impressions.

1,500+

Dealflow Pipeline Annually

100+

Active Investor Members

100+

Speakers

8HR

Workshops

RVC is more than just an angel investing group. It's a community of like-minded people with varying backgrounds that gives us collective investment wisdom.

Let’s join together

100+

Events and meetings each year

~75

Pre-vetted deals presented annually

Why Choose Us

What Makes Us the Right Angel/Venture Capital Partner

100% Trusted Rate

RVC is the longest running angel group iin the USA, operating as a community leader for over 40 years.

Industry Agnostic

We invest in technology, AI, life science, cleantech, CPG and other industries that have the ability to return 10 times our investment or more in five years. Our broad community gives us expertise in multiple industries.

Investing Know-how

We have the "pattern matching" to invest in the most promising companies, and with over 220 investments, we know how to win.

Community Support

We educate and empower communities through free events and workshops.

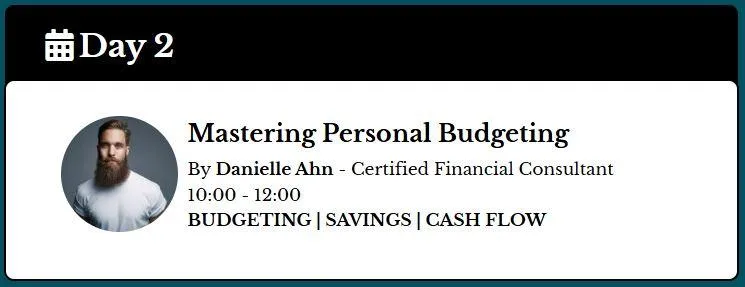

Upcoming Events in 2026

January

January

Angel 101

By Peter Adams - RVC Executive Chairman

Learn the landscape of venture capital and angel investing. We cover everything from valuation, diligence and tax strategies to how venture capital funds work.

Pitch Academy

By Kevin Kudra - RVC Executive Director

A workshop to coach startups in presenting the best pitch and much more. Investors get an early view of the companies and can provide mentorship if desired.

January

January

Angel Forum

By Kevin Kudra - RVC Executive Director

Meet with other investors to see pitches from new companies and to review the "deals in play" with completed due diligence and term sheets negotiated. Ask questions, share insights and learn from experienced investors.

Funding Mastermind

By Peter Adams - RVC Executive Chairman

Get together with other investors and bring your questions. Term sheets, diligence, valuation, or whatever you're curious about.

Pricing Plans

Flexible Membership Levels to Match Your Needs

$97

per Month

Investor Education & Coaching

- Weekly pre-vetted investment deals with due diligence packages, negotiated term sheets, and SPV membership.

- Angel Forums & Deep Dives (live or online when available).

- Ability to lead deals (and share in carried interest) and serve on boards (when available).

- Opportunity to join the Screening Team to see how top deals are selected (Angel Accelerator required).

- Opportunity to join the Due Diligence Team for deeper evaluation experience (Angel Accelerator required).

- 25% discount on carried interest on SPV investment vehicles.

Deal Flow & Investment Access

- Angel 101 webinar (foundation-level training).

- Pitch Academy + Pitch Review (advance your deal evaluation skills).

- Weekly live Q&A coaching sessions with seasoned investors.

Community & Networking

- Investor/startup community platform for posting questions and collaborating.

- Social events and networking opportunities.

- Membership in the Angel Capital Association — the largest professional network for angels.- 50% discount on RVC events (live, online, and hybrid).

GHL Investor CRM System, including:

- AI inbound/outbound voice agents

- Email/SMS campaigns

- 1,000 pre-loaded VC/angel investor contacts

- Cold outreach templates

- Investor automations

- Landing pages & website hosting

- Custom AI web assistant connected to your knowledgebase

Venture Capital ChatGPT Knowledgebase (AI-powered resources for learning & research).

$297

per Month

Advanced Investor Training & Accelerator Programs

- Full Angel Accelerator Program — structured curriculum for mastering angel investing.

- Weekly cohort calls with live coaching, deal defense sessions, discussions, and Q&A.

- HyperAccelerator Program — intensive 2-week experience including live mentors, certification, and a Demo Day.

- 1:1 live mentors for every module.

Deep-Dive Investing Workshops

- Pitch Academy — learn how to present and evaluate high-quality pitches with live feedback.

- Venture Capital & Angel Investing 101 — an insider’s overview of successful venture investing.

- Valuation Workshop — five valuation models for pre-revenue and early-revenue companies.

- Term Sheets, Negotiation & Deal Structure — how to structure investor-friendly, founder-aligned deals.

- Exit Strategy Workshop — design exits using the Exit Strategy Canvas.

- Due Diligence Mastery — legal preparation, data rooms, and practical diligence techniques.

Startup Growth & Strategy Masterclasses

- Scaling with OKRs and strategic planning frameworks.

- Go-to-Market and channel strategy development, plus key sales metrics.

- Pro formas & financial projections — creating believable five-year models.

- Capital stack strategies — managing capital to hit milestones with minimal dilution.

- Hyper-Mentorship — techniques for accelerating company growth as a mentor.

Venture Capital Skills & Fund Management

- Venture Capital fund structure, strategy, and management.

- Post-investment management: portfolio construction, follow-on funding, board seats, and exit preparation.

- Limited Partnership education — how to evaluate VC funds, roles, responsibilities, and portfolio strategy.

- Opportunity to apply to join the Rockies Venture Funds VC Team as a Venture Partner, participating in deal sourcing, LP engagement, and investment evaluation.

Events & Community Access

- Free access to all RVC live, online, and hybrid conferences and events.

- Full access to investor/startup collaboration community and networking opportunities.

100% Trusted Quality

Backed by over 40 years of industry expertise, we deliver venture capital funds for a professionally managed diversified portfolio or SPV investments for those who want to make their own decisions and invest in a single company.

Our Team

The Experts Guiding Your Financial Future

Peter Adams

Executive Chairman

Kevin Kudra

Executive Director

Follow Us

© 2025 Rockies Venture Club - All Rights Reserved.